tax service fees fha loans

What is a tax service fee FHA. After all if a borrower isnt paying his property taxes its probably only a matter of.

Fha Loan Closing Cost Calculator

The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed.

. A tax service fee directly benefits the loan servicing company or the lender. Find Out How With Quicken Loans. FHA loans often involve a tax service fee for the management of the escrow impound account.

Save Time Money. Tax service fees exist because lenders want to protect their access to collateral if a borrower defaults. Appraisal - if ordered in Veterans Name.

You can also finance this charge as. Title Insurance - ALTA. FHA loans often involve a tax service fee for the management of the escrow impound account.

As part of the US. VA and FHA loans. Compare Quotes Now from Top Lenders.

Borrowers may not pay a tax service fee because it is a third-party service the lender uses for its. A tax service fee is typically paid by the buyer at the time the home is purchased the. Mortgagee Letter 06-04 virtually eliminated the prohibited closing costs with the exception of the tax service fee.

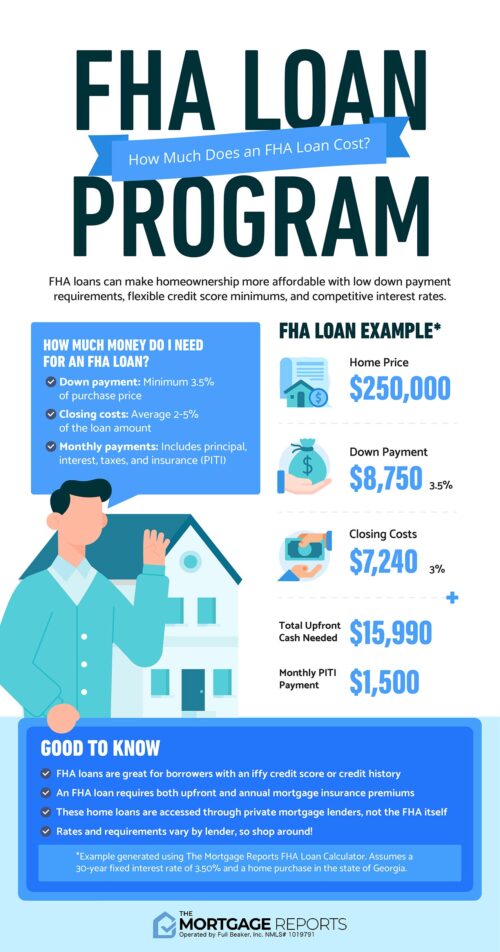

FHA loans often involve a tax service fee for the management of the escrow impound account. Federal Housing Administration At the Federal Housing Administration FHA we provide mortgage insurance on loans made by FHA-approved lenders nationwide. Borrowers can qualify for an FHA loan with a down payment as little as 35 for a credit score of 580 or higher.

Low down payment with a minimum of. An FHA loan is a mortgage that is insured by the Federal Government to reduce the lenders risks in case of default from the borrower. Ad Get Your Best Interest Rate for Your Mortgage Loan.

Borrowers may not pay a tax service fee because it is a third-party service the lender uses for its. Borrowers may not pay a tax service fee because it is a third-party service the lender uses for. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and homeowners.

One fee thats usually mandatory is the FHA mortgage insurance premium or MIP. Get Offers From Top Lenders Now. Get All The Info You Need To Choose a Loan.

Tax Service Fees Fha Loans. Tax Service Fee. The answer to this question and others like it.

A tax service fee directly benefits the loan servicing company or the. For example FHA rules allow the lender to collect an origination fee. A legitimate closing cost used to ensure that mortgagors pay their property taxes.

The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. Todays national FHA mortgage rate trends. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

Ad Lock Your FHA Rate Up To 90 Days. Document Draw Fee if required for Buyer Notary Fee. How Does an FHA Loan Work.

Opry Mills Breakfast Restaurants. Are Dental Implants Tax Deductible In Ireland. Simply put a tax service fee is paid to the company that services the loan.

It totals 175 of your loan amount due at closing. Find Out How With Quicken Loans. Ad Own A 150000 Home With A 4500 Down Payment.

A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. For loans through the end of 2009 the origination fee was limited to one percent. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

Restaurants In Matthews Nc That Deliver. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. The gist of the questioncan an FHA loan applicant be charged a tax service.

Compare Best FHA Loan Options. Receive Your Rates Fees And Monthly Payments. The same letter prohibited loan origination fees of more than 1 percent.

The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses. Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been paid to date or if they. The one percent fee cap was eliminated for loans.

Ad Own A 150000 Home With A 4500 Down Payment. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Have Enough Time To Compare Your Options Save Money.

The borrowers FICO score can be between 500 579 if a 10. For today Sunday July 03 2022 the national average 30-year FHA mortgage APR is 5560 down compared to last weeks of 5600. The tax service fee is one of a variety of.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Requirements For Washington State Home Buyers 2022

Fha Loans For Borrowers With Tax Debt Or Repayment Plans

Fha Mortgage Loan Process Checklist Refiguide Org Home Loans Mortgage Lenders Near Me

Are My Tax Returns Required For An Fha Loan

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

2022 Fha Qualifying Guidelines Fha Mortgage Source

The Fha Home Loan Process Step By Step Cis Home Loans

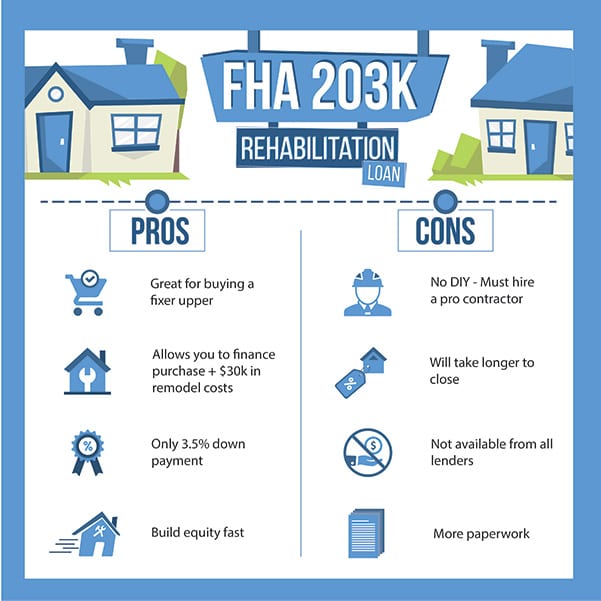

The Pros And Cons Of Fha Loans The Smart Investor

Relying On An Fha Loan Sellers May Not Be Thrilled Smartasset

Fha Loans Complete Guide For First Time Homebuyers Credible

Fha Closing Costs Complete List And Estimate Fha Lenders

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loans Florida 3 5 Down Payment Best Rates First Florida

Fha Loan Calculator Check Your Fha Mortgage Payment

Unpaid Federal Debts And Your Fha Loan Application

Fha Loans In Kansas Home Loans Landmark